Weekly Market Commentary - June 7th, 2025 - Click Here for Past Commentaries

-

Despite some signs of cooling, the May jobs data came in better than expected, easing concerns

about a sharp economic slowdown amid ongoing tariff headwinds. The theme of low hiring and low

firing persists, while wage growth continues to outpace the rate of inflation.

Markets have rebounded impressively, with global equities hitting new highs, up 20% since the

April lows, supported by solid fundamentals, easing trade tensions, and strong corporate earnings.

While valuations have undoubtedly contributed to the recent gains and potentially indicate some

complacency, earnings have also played an important role in supporting the rally from the bottom,

especially within mega-cap tech.

Risks remain from trade and policy uncertainty, including tariff deadlines, Fed rate decisions,

and the debt-ceiling debate. Volatility may increase, but resilience in fundamentals helps provide

a strong foundation.

-

Summer isn't typically associated with tests – but this year may be an exception for markets. After

a solid run supported by resilient fundamentals, investors now face a season that could bring

meaningful catalysts. From potential trade developments and tariff headlines to evolving fed

policy and fiscal debates, the months ahead may test the recent momentum and shape the market's

direction for the second half of the year.

We share our take on the latest employment report, the first major economic release of the summer, and our view on where key drivers stand ahead of a likely eventful next couple of months.

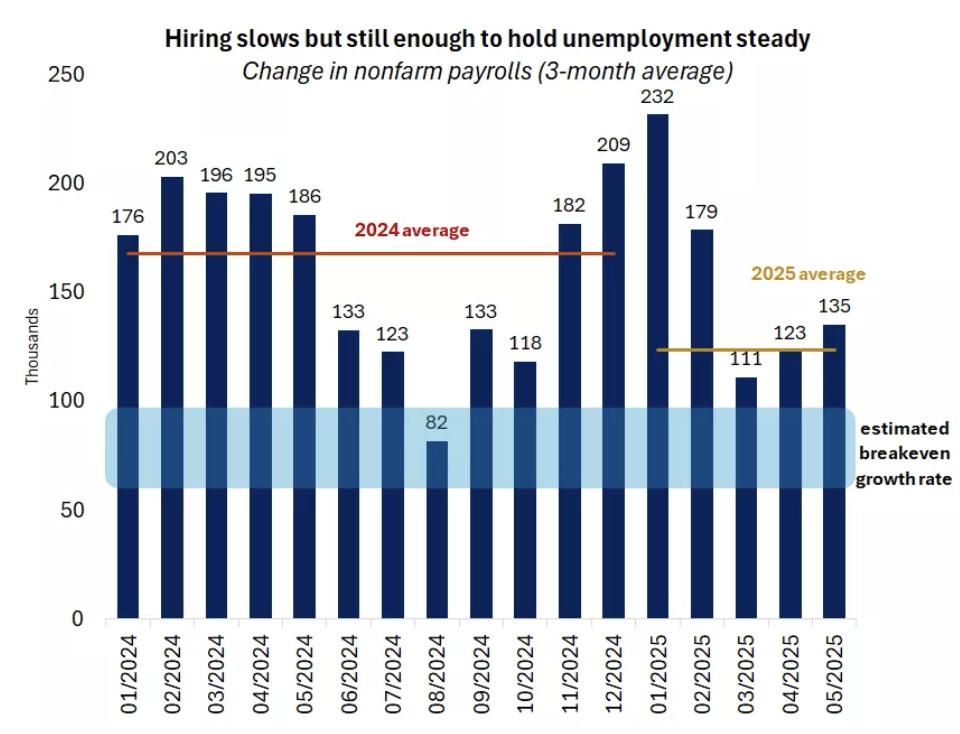

All eyes were on last week's jobs report, as employment trends remain a key gauge of consumer strength amid ongoing tariff headwinds. To the market's relief, the May data helped ease concerns about a sharp slowdown, showing that while the labor market is gradually cooling, the sky is not falling.

Digging into the details, the U.S. economy added 139,000 jobs in May, slightly above expectations, while the unemployment rate held steady at 4.2%. For context, that rate remains in the lowest 10% of all historical observations dating back to 1948. Health care was a major contributor to job growth (+62,000), followed by leisure and hospitality (+48,000). On the downside, manufacturing employment declined 8,000, potentially reflecting tariff headwinds, and federal government employment fell by 22,000, the largest monthly drop since 2020. More broadly, the pace of job gains remains above what is needed to prevent unemployment from rising. This year's theme of low hiring and low firing persists, while wage growth continues to outpace the rate of inflation.

However, the May report wasn't without blemishes. Job gains for the previous two months saw sizable downward revisions, a persistent trend over the past three months. The labor-force participation rate also declined, possibly reflecting tighter immigration policy.

Overall, we think the report underscores the resilience of the U.S. economy, even amid signs of moderation. With limited evidence of broad tariff-related damage so far, the data helps support the case for the Fed to remain on hold for now.

-

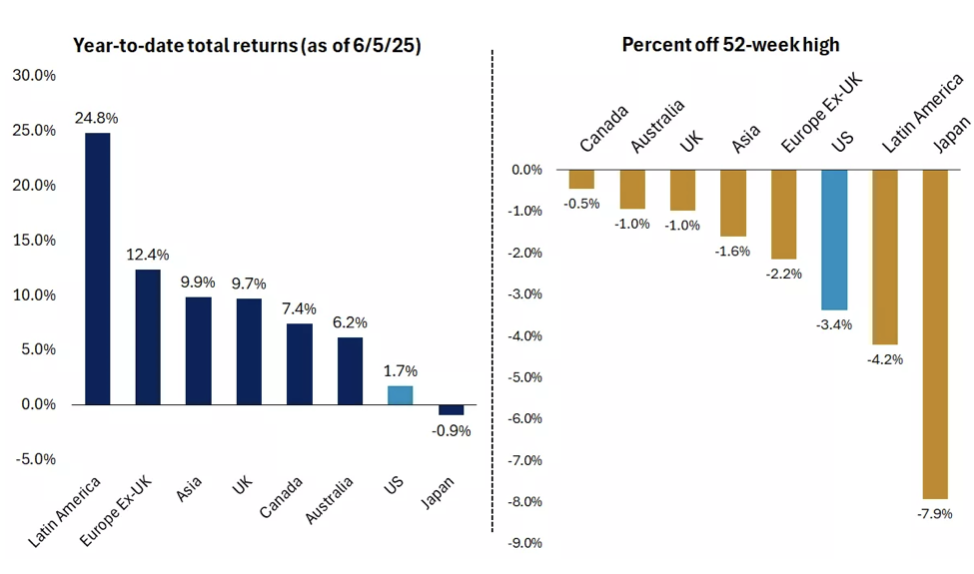

Last week the MSCI All Country World Index, a proxy for global equities, reached an all-time high.

This outcome wasn't widely expected following the announcement of steep tariffs. Yet just two

months after the April 8 low, stocks have mounted an impressive recovery, with the S&P 500

gaining nearly 20% since then. However, it remains about 3% below its record high and trails

some of its international large-cap peers.

We don't think this rally is built on sand, as it is supported by still-solid fundamentals. Trade tensions have eased, policy focus has shifted toward tax cuts, and economic data remain resilient. And corporate profits continue to grow at a healthy pace (more on that below). That said, valuations have completed a full round trip, which could foster a sense of complacency and leave less margin for error as growth decelerates.

Nevertheless, we think markets are appropriately beginning to look ahead, setting their eyes on the possibility of more stimulative fiscal and monetary policies in 2026.

-

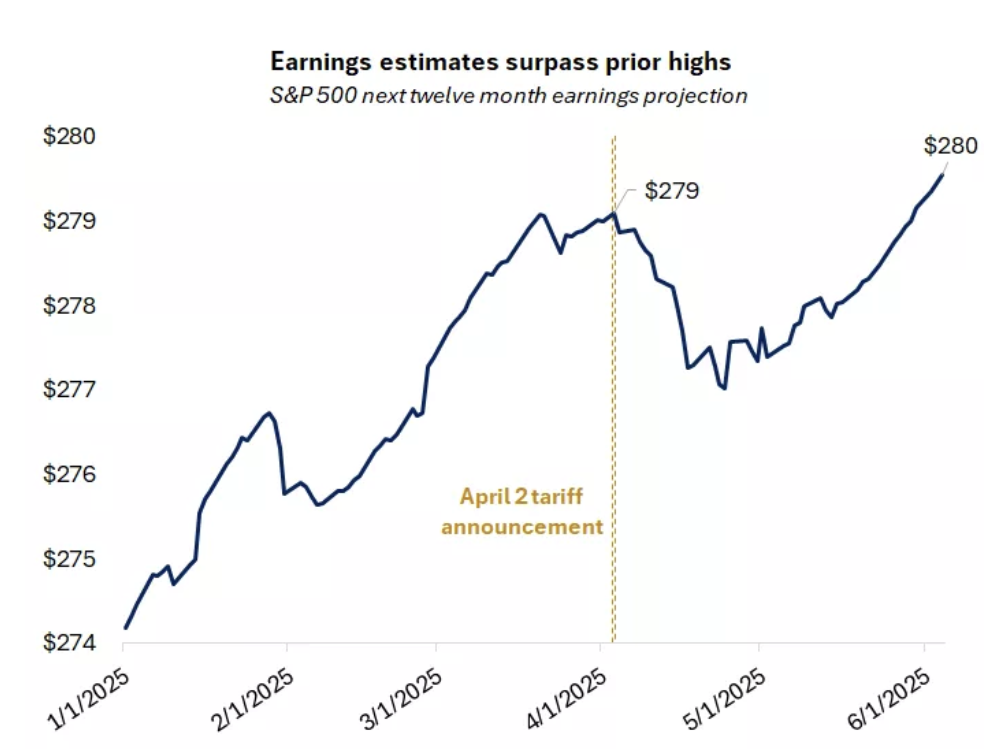

Despite macroeconomic headwinds and headline volatility, S&P 500 companies delivered solid

results, growing profits 12.5% year-over-year, the third quarter of double-digit growth in

the past four. While earnings growth estimates for 2025 have been revised down from 14%

to 8.5%, the 2026 outlook remains steady, pointing to the potential for reacceleration.

Notably, the forward 12-month earnings estimate has recently reached a new high, providing a fundamental anchor for rising equity markets. While valuations have undoubtedly contributed to the recent gains, earnings appear to have also played an important role in supporting the rally from the bottom.

A pull forward in demand ahead of higher tariffs may have boosted first-quarter results. Still, much of the upside came from the three growth sectors - information technology, communication services and consumer discretionary - which together account for over 50% of the S&P 500. Tech earnings grew 20%, communication services surged 33%, and consumer discretionary rose 8%, helping to restore investor confidence in this part of the market that fell briefly out of favor earlier this year.

Results also highlighted robust spending on artificial intelligence (AI), helping NVIDIA reclaim the title of world’s most valuable company.

-

The July 9 expiration of the 90-day pause on “reciprocal” tariff rates and the Aug. 12 end

of China’s 90-day pause pose potential catalysts for volatility. Bilateral negotiations are

complex, while new sectoral investigations on pharma and semiconductors are underway.

Furthermore, the recent court decision challenging President Trump’s authority to impose

reciprocal tariffs affects about two-thirds of the proposed tariff hikes and adds another

wrinkle to the trade saga. Considering all the moving pieces, we suspect that these

self-imposed deadlines may be extended if needed to allow more room for deals to be

reached.

Two months ago the bond market was fully pricing in a rate cut at the Fed's June 18 meeting. That probability has now fallen to near zero, as the economy continues to chug along and Fed officials are taking a wait-and-see approach1. The effects of tariffs may start to appear in economic data during the summer, but the Fed is unlikely to have the clarity to act in June, or even possibly the July 30 meeting. A September move, though, appears likely. We think the Fed may cut interest rates twice this year as unemployment ticks higher and any inflation jump likely proves temporary.

After the House of Representatives passed the reconciliation bill ("Big Beautiful Bill") by a narrow margin, it has now moved to the Senate, and the debate about many of its provisions and their contribution to the deficit has heated up. The bill includes a boost in the debt ceiling, adding urgency to lawmakers to reach an agreement ahead of the X-date, when the Treasury runs out of cash. Treasury Secretary Bessent has urged Congress to increase or suspend the debt limit by mid-July. That timeline puts pressure on Republicans to quickly agree on a sizable tax and spending package in the coming weeks.

-

Headline noise is a reality that investors will have to continue grappling with over the summer.

However, even with the known unknowns on trade, the bull market remains supported by solid

fundamentals. The Atlanta Fed's GDP model points to 3.8% growth in the second quarter as

the import surge reversed, labor market conditions are healthy, and the Fed's preferred

measure of inflation hit a four-year low. One would be correct to point out that this is

old news, but the starting point is a healthy one as some of that strength likely fades

in the second half.

Easier fiscal policy and Fed rate cuts may help reaccelerate growth in 2026, while political and economic realities may help prevent the U.S. administration from following a very aggressive stance on trade. We continue to recommend slightly overweighting equities over bonds, though bonds can still help smooth out volatility if it re-emerges. While a significant bond rally appears unlikely without a recession, it is encouraging that the 10-year yield has fallen below 4.5% despite the perfect storm of the U.S. debt downgrade, the deficit concerns surrounding the new tax bill, and the jump in long-term Japanese bond yields.

From an investment style perspective, we think a balance between growth and value is warranted, as the recent earnings season was a good reminder of the earnings power of mega-cap tech even as the broadening in leadership continues.

-

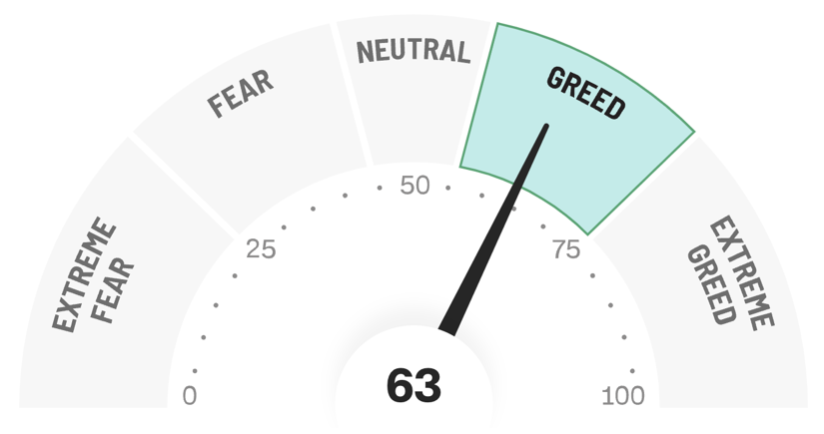

Final Words: Market indicates greed. No new buys. Hold.

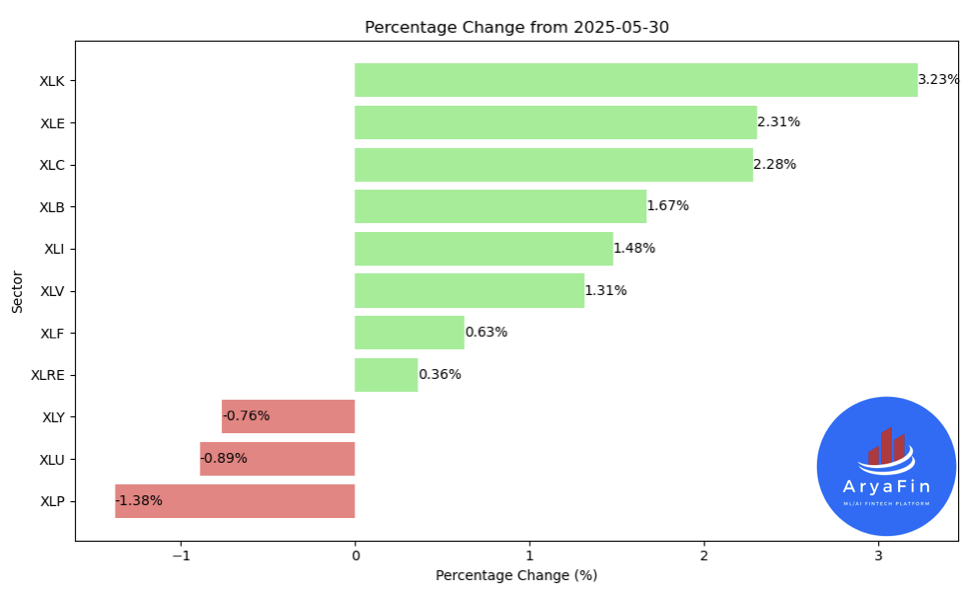

Below is last week sector performance report.

Top 11 Sector Performance for week of June 2-6, 2025

#XLP (The Consumer Staples Select Sector SPDR Fund): -1.38%

#XLU (The Utilities Select Sector SPDR Fund): -0.89%

#XLY (The Consumer Discretionary Select Sector SPDR Fund): -0.76%

#XLRE (The Real Estate Select Sector SPDR Fund): 0.36%

#XLF (The Financial Select Sector SPDR Fund): 0.63%

#XLV (The Health Care Select Sector SPDR Fund): 1.31%

#XLI (The Industrial Select Sector SPDR Fund): 1.48%

#XLB (The Materials Select Sector SPDR Fund): 1.67%

#XLC (The Communication Services Select Sector SPDR ETF Fund): 2.28%

#XLE (The Energy Select Sector SPDR Fund): 2.31%

#XLK (The Technology Select Sector SPDR Fund): 3.23%

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

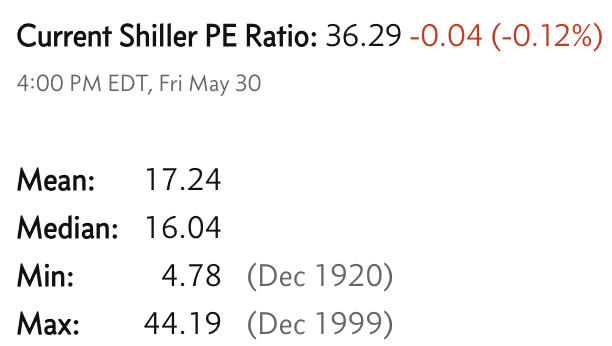

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.