Weekly Market Commentary - June 14th, 2025 - Click Here for Past Commentaries

-

Economic data has delivered in the first few months of the year – despite the uncertainties

around tariffs, trade and geopolitics. We review three key measures: GDP growth, the labor

market and inflation, all of which have been resilient thus far.

As we head to the second half of the year, there are several catalysts to monitor: Trade negotiations

with China and other economies, a potential tax bill in the U.S., and ongoing geopolitical tensions,

which historically have had a short-lived impact on financial markets.

Overall, in this environment, we believe bouts of volatility can be used as opportunities to add

quality investments at better prices. We continue to favor diversification and broadening

leadership as key investment themes.

-

While U.S. GDP was soft in the first quarter, driven in large part by a huge spike in inventories,

it appears to be on pace to exceed 3% in the second quarter. This is driven by solid household

consumption figures forecast at about 1.7% annually. Despite weak consumer-sentiment reports

(which last week started to show signs of stabilization), we continue to see actual consumption

holding steady, perhaps as inflation has remained contained and the job market has been

resilient.

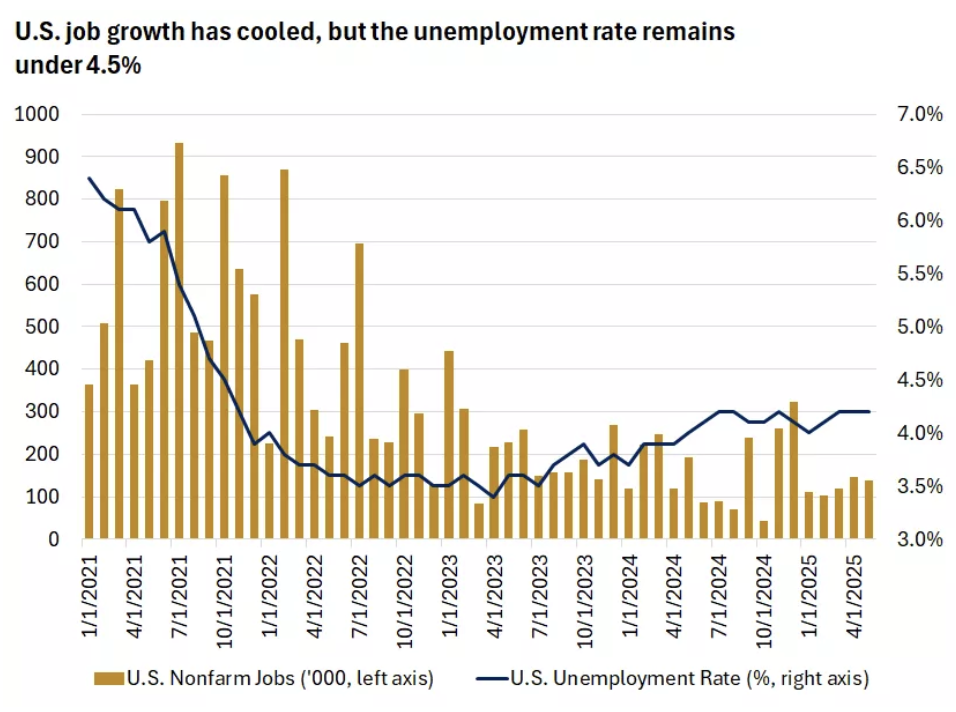

While job growth is cooling, we continue to see an unemployment rate of around 4.2%, well below the long-term average in the U.S. of about 5.5%. The current labor backdrop can be characterized as one of low hiring but also low firing, as corporations look to hold on to top talent.

Notably, wage gains of around 3.9% continue to outpace inflation, which means consumers appear to be benefiting from positive real wages. Consumers tend to feel most comfortable spending when they feel secure in their jobs and are seeing wage increases outpace inflation, both of which are in place and remain supportive for now.

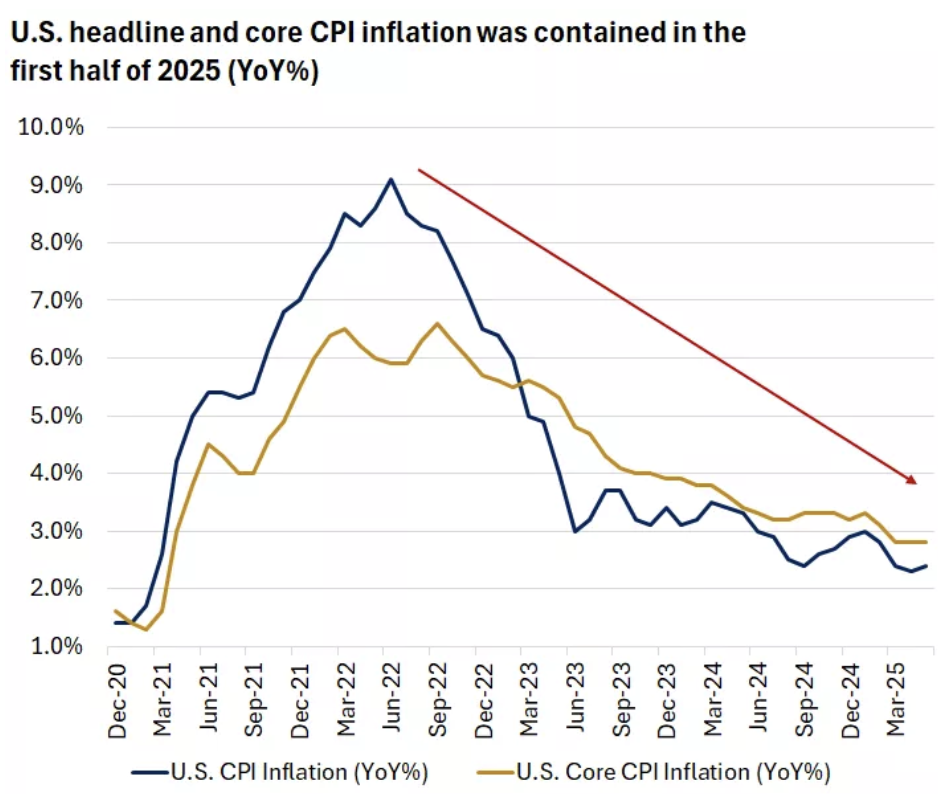

Last week, we got updated May data for both consumer price index (CPI) and producer price index (PPI) inflation. Both sets of inflation data surprised to the downside, with headline CPI inflation around 2.4%, and PPI inflation around 2.6%. Overall, inflation data is well below its peak levels in 2022 when CPI inflation topped 9% and PPI inflation was over 18% and has made substantial progress towards the Fed's 2.0% inflation target.

In our view, tariffs have not yet impacted goods prices, perhaps because companies have built inventories, and they continue to do so even during this 90-day pause. This should help alleviate pricing pressure, even as we head to the back half of 2025, in our view. However, depending on final trade deals, we would expect to see goods pricing increase in the months ahead.

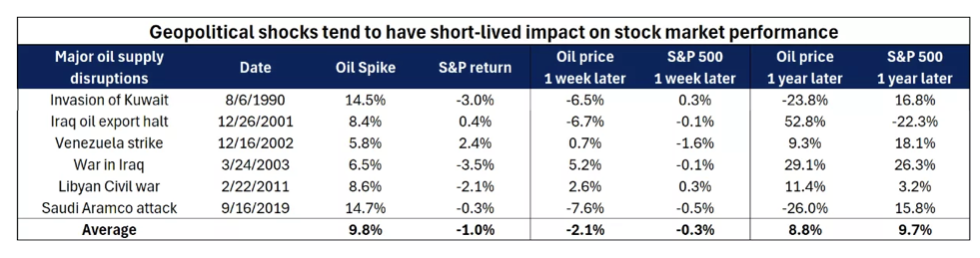

We are also watching the impact of geopolitical tensions on inflation, particularly oil and energy prices. Last week, for example, we did see oil prices move up between 5% and 7% in response to the unrest in the Middle East. However, historically, these sharp moves in commodity prices driven by geopolitics tend to be short-lived. The U.S. is also relatively less exposed to oil shocks as it is a net exporter of petroleum products and has reduced its spending on energy as a percent of GDP.

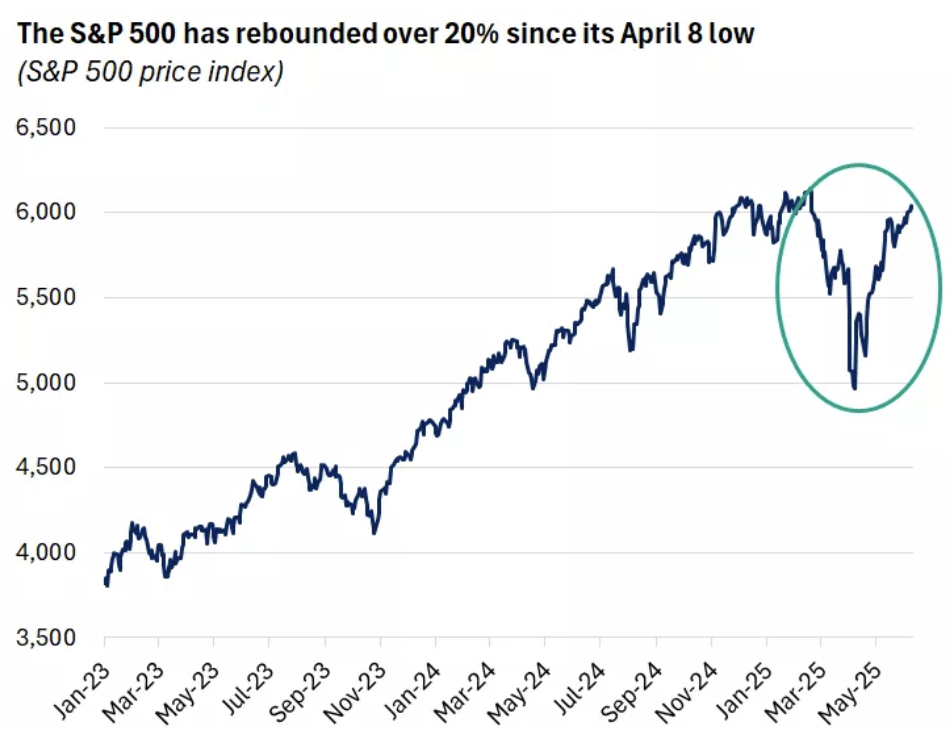

Some of this better economic and inflation data has been reflected in recent stock-price movements. After falling nearly 20% from the mid-February highs, the S&P 500 has since rebounded and recovered over 20%.

In our view, this reflects both solid economic and earnings data, as well as the U.S. administration walking back some of the higher tariff rates. However, we would expect bouts of volatility as investors digest key catalysts in the weeks ahead.

-

Over the last week, we have gotten a few key updates on the trade and tariff negotiations.

Perhaps the two we are watching most closely is a potential deal with China and the July 9 end

of the 90-day pause with other major trading partners:

This past week, we heard from both U.S. and Chinese officials that a trade framework between the economies has been established. This includes tariffs on Chinese exports coming down from 145% to 55% (10% reciprocal tariffs, 20% fentanyl-based tariff, and 25% existing tariff on China). Tariffs on U.S. exports to China meanwhile remain at 10%.

In addition, there is further agreement on nontariff barriers, including critical Chinese rare-earth minerals. China has agreed to temporarily restore rare-earth licenses to U.S. manufacturers for six months, while the U.S. will relax restrictions on Chinese jet engines and related parts. While a step in the right direction, the U.S. and China trade relationship is a critical one to monitor in the months ahead.

Meanwhile, the end of the 90-day pause on non-Chinese trading partners is fast approaching on July 9. Last week, Treasury Secretary Bessent indicated that the administration may extend the 90-day pause for top trading partners, if they show "good faith" in ongoing trade negotiations. We know that establishing trade deals that address tariff and nontariff barriers can take time, often months or years, and we would expect some extension for partners who are currently in discussions with the U.S. However, even during this pause, tariffs on these partners remain somewhat elevated at 10%.

The bottom line, in our view, is that uncertainty around tariffs remains, but the worst-case outcome or the highest tariff rates that were outlined on April 2 will likely be avoided. Nonetheless, it is likely that tariff rates in the U.S. will move substantially higher from the approximate 2% rates we saw at the beginning of the year, to potentially 10%+ and even higher on China and other select sectors.

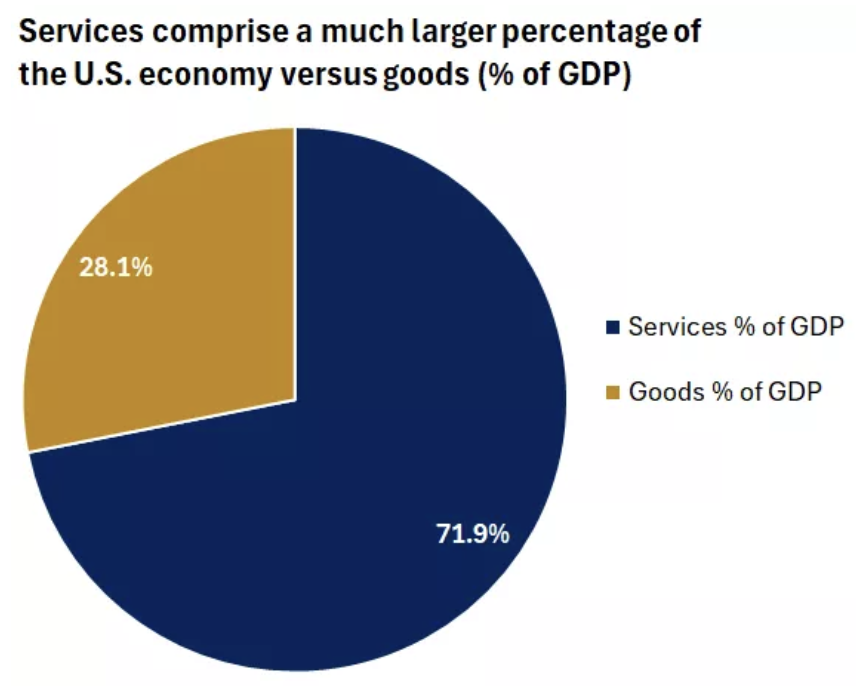

This will likely weigh on both inflation and economic growth, as prices on goods move higher and consumption potentially slows. But it is important to keep in mind that the U.S. is a services-driven economy, with around 70% of GDP coming from services sectors. While tariffs could impact goods pricing and demand, they may not have as broad of an impact on a service-led U.S. economy.

In addition, while prices on goods may move higher, they can be offset by a number of factors: Companies building inventories ahead of tariffs, diversifying supply chains where they can, and even absorbing some of the higher tariff costs themselves without passing it on to consumers. Thus, while we expect prices to rise marginally and growth to slow in the quarters ahead, we still see positive economic growth at or slightly below trend levels, and we do not yet see a U.S. recession or downturn on the horizon.

-

Last week, tensions in the Middle East flared again, as Israel carried out airstrikes against

Iran, targeting nuclear-program facilities. The U.S. administration confirmed it was not involved

in the strikes. This unrest nonetheless sparked a risk-off sentiment in equity markets globally,

as well as a flight-to-safety response in U.S. dollar assets and a sharp move higher in oil prices.

Three key points to keep in mind as we navigate geopolitical uncertainty:

- Geopolitical tensions, while often taking a huge human toll, typically have short-lived impacts on financial markets and tend to be met with a flight-to-safety response as well as a rise in commodity/oil prices.

- The impact on international markets historically can be more severe than U.S. markets. The U.S. is a relatively insulated economy and isn't as dependent on trade or energy as global economies.

- Balanced portfolios tend to perform better during these times. The rise in the energy and commodity sectors can offset some of the broader equity market volatility, as an example.

-

Finally, we will also be watching the U.S. tax bill and the Fed in the weeks ahead. We are monitoring

how the tax bill unfolds in the Senate ahead of July 4, and what the final details in this bill include.

In our view, while there are some marginally stimulative measures being proposed in the potential tax

bill, the biggest component is the extension of the Tax Cuts and Jobs Act. This, however, is status

quo to the current tax backdrop and may not alter corporate spending or behavior meaningfully.

However, the increased focus on areas like accelerated capital-expenditure deductions and potential deregulation in several sectors could help reaccelerate corporate spending and broader "animal spirits." This may occur more meaningfully in 2026, as the provisions of the new bill start to kick in.

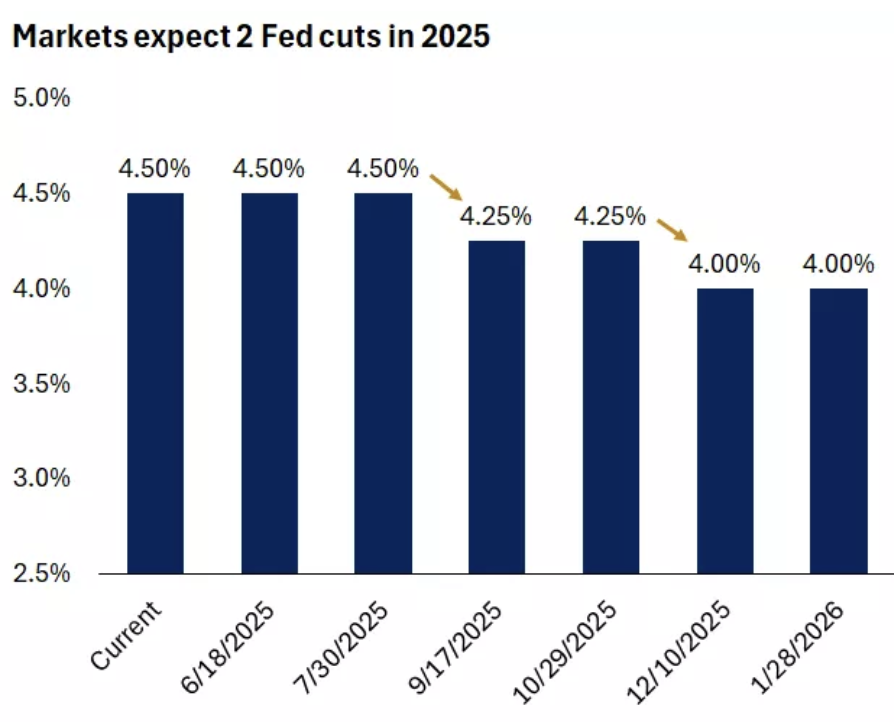

Lastly, we would expect the Fed to cut interest rates in the back half of the year as well. For now, the Fed is likely in wait-and-see mode as we get further clarity on tariffs and potentially see their impact on the economic data. However, the current fed funds rate of 4.25% - 4.5% remains above inflation rates of around 2.5% - 3.5%, and thus the Fed has some room to move lower. If the economy or labor market softens, the Fed is more likely to cut rates – in our view, we see one to two rate cuts in 2025 as likely.

-

Overall, economic data held up well in the first half of 2025, despite uncertainty around trade,

taxes and geopolitics. After a strong run in stock markets, we could see bouts of volatility emerge

as investors digest news on tariffs, a new tax bill, and ongoing geopolitical unrest.

However, as we head into the back half of 2025 and into 2026, investors may have a better setup: the Fed may be cutting rates, and we should have more clarity on tariffs, deregulation, and taxes, in our view. There is the potential for corporate earnings growth to reaccelerate next year as well.

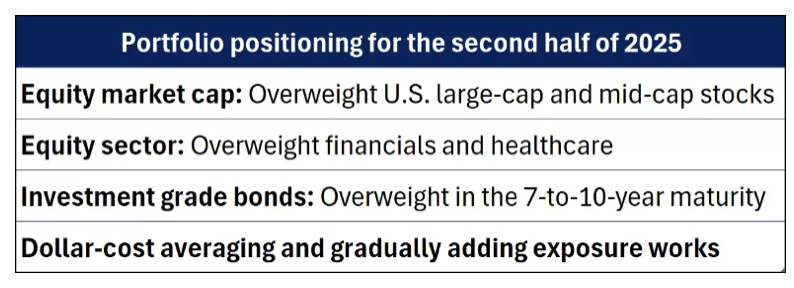

In this environment, we believe bouts of volatility can be used as opportunities to add quality investments at better prices. We continue to favor diversification and broadening leadership as key investment themes.

We recommend overweight positions in both U.S. large-cap and mid-cap stocks. From a sector perspective, we favor financials and health care. And within investment grade bonds, we see value in the seven- to 10-year maturity space, with yields still favorable around 4.4%.

Remember, for long-term investors, talking to your financial advisor in periods of uncertainty can be helpful. We recommend establishing strategies like dollar cost averaging to gradually and consistently add exposure to markets according to your personalized investment strategy, which can lead to meeting and even exceeding long-term financial goals.

-

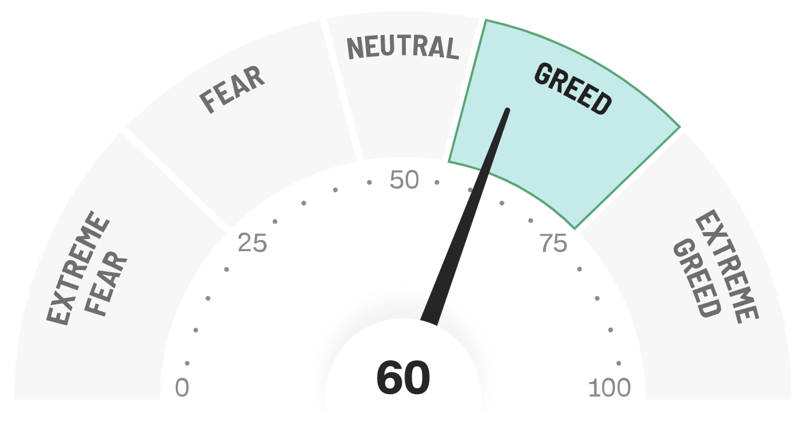

Final Words: Market indicates greed. No new buys. Hold.

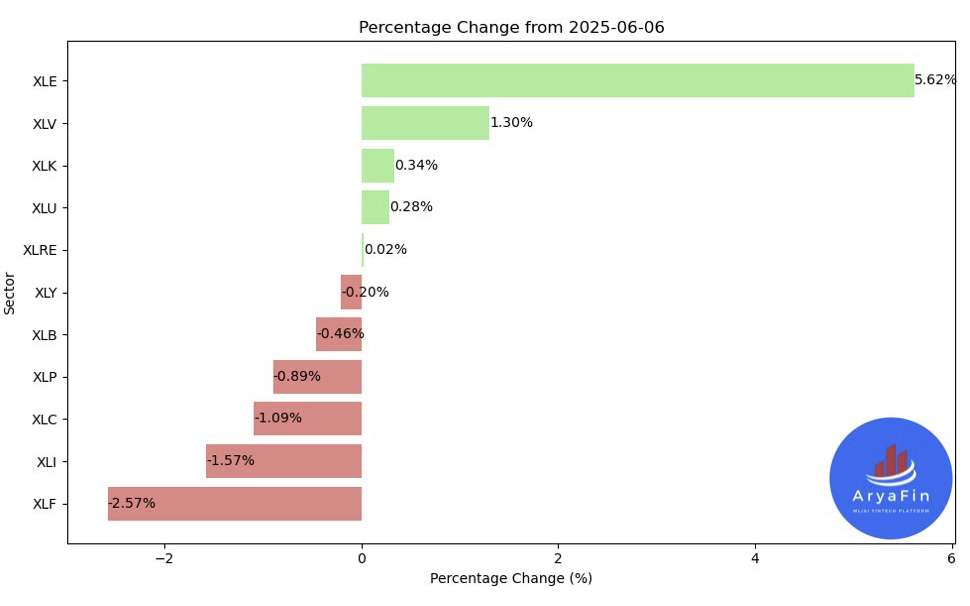

Below is last week sector performance report.

Top 11 Sector Performance for June 9-13, 2025:

#XLF (Financial Select Sector SPDR Fund): -2.57%

#XLI (Industrial Select Sector SPDR Fund): -1.57%

#XLC (Communication Services Select Sector SPDR Fund): -1.09%

#XLP (Consumer Staples Select Sector SPDR Fund): -0.89%

#XLB (Materials Select Sector SPDR Fund): -0.46%

#XLY (Consumer Discretionary Select Sector SPDR Fund): -0.20%

#XLRE (Real Estate Select Sector SPDR Fund): 0.02%

#XLU (Utilities Select Sector SPDR Fund): 0.28%

#XLK (Technology Select Sector SPDR Fund): 0.34%

#XLV (Health Care Select Sector SPDR Fund): 1.30%

#XLE (Energy Select Sector SPDR Fund): 5.62%

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

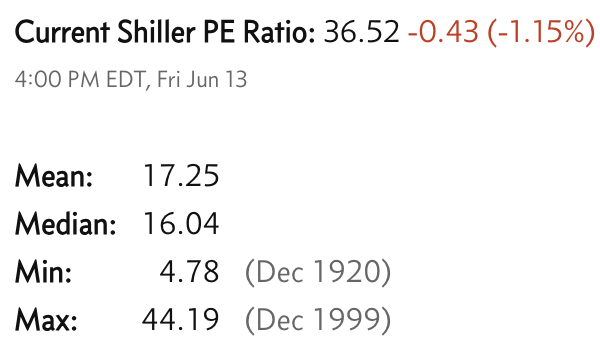

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.